SIGN UP TO THE MILLENNIALS WITH MONEY NEWSLETTER FOR A COUPON ENABLING FREE DOWNLOAD OF THIS PRODUCT

If you’re planning a move to Spain or have recently moved, it’s important to know how much tax you might end up paying. There are very few accessible and easy to use resources available in English for foreigners moving to Spain, and it can therefore be easily overlooked and misunderstood.

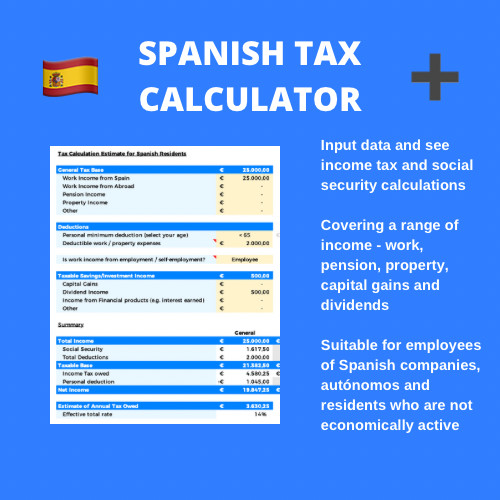

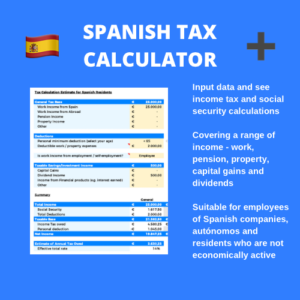

Millennials With Money has developed a simple and straight forward downloadable tax calculator to help you understand how much tax and social security based on a range of inputs:

- Work income: Whether it is earned in Spain or from outside of Spain

- Pension: For income if you are retired and receive a state or private pension

- Property Income: For those earning income from rental properties, in or outside of Spain

- Investing Income: For dividend or interest income, or profits generated from the sale of assets (such as property or stocks)

This file can be used by people employed by a Spanish company, people who have registered as self-employed (autónomo) in Spain, and people who are not economically active, such as retirees or people on a Non-Lucrative Visa (NLV).

DISCLAIMER: This file is for informative and educational purposes only and does not constitute tax advice or professional recommendations. Millennials With Money OÜ cannot be held responsible for any decisions taken based on calculations in this document.